how to pay sales tax in wyoming

How long do you have to pay sales tax on a car in Wyoming. Ad New State Sales Tax Registration.

How To File And Pay Sales Tax In Wyoming Taxvalet

44 Business Consumer Use Tax.

. In Cheyenne for example the county tax rate is 1 for Laramie County. At 4 the states sales tax is one of the lowest of any state with a sales tax though counties can charge an additional. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547.

Wyoming law requires that sales tax must be paid on a vehicle within 60 days of the date of purchase. So taxes you pay are comparatively low in the country which makes Wyoming. State wide sales tax is 4.

To know what the current sales tax rate applies in your state ie. Wyoming Use Tax and You. Sales Tax Wyoming information registration support.

Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. Groceries and prescription drugs are exempt from the Wyoming sales tax. In other words be sure to subtract the trade-in amount from the car price before calculating sales tax.

Mary owns and manages a bookstore in Cheyenne Wyoming. To file sales tax in Wyoming you must begin by reporting gross sales for the reporting period and calculate the total amount of sales tax due. Ad Accurately file and remit the sales tax you collect in all jurisdictions.

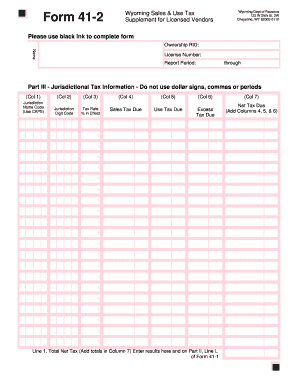

42-1 Sales and Use Tax Return for Annual Filers. 43-1 Sales and Use Tax Return for Occasional Vendors. What taxes do you pay in Wyoming.

IMPORTANT Please click here to review current tax rates and future. You dont have to pay sales tax on trade-ins in Wyoming. In addition to Wyomings retail sales tax and use tax business taxpayers must collect or pay several other taxes including a use tax local taxes and special taxes.

Wyoming has no state income tax. While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation. You can look up the local sales tax rate with TaxJars Sales Tax Calculator.

The Excise Division is comprised of two functional sections. Businesses licensed under the Wyoming sales tax laws must report use tax on their sales tax return forms ETS Form 41-1 or 42-1 and 42-2. On top of the state sales tax there may be one or more local sales taxes as well as one or.

What purchases are taxable in Wyoming. Easily manage tax compliance for the most complex states product types and scenarios. Sales and use tax for.

We advise you to check out the Wyoming. 45-1 Contractor Use Tax Return. The taxability of various transactions like services and shipping can vary from state to state as do policies on subjects such as whether excise taxes.

In addition Local and optional taxes can be assessed. Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied. Your Wyoming Sales Tax Filing Requirements.

Since books are taxable in the state of Wyoming Mary. Heres an example of what this scenario looks like. This page discusses various sales tax exemptions in Wyoming.

Wyoming follows the rule of no state income tax which means no estate tax no state gift tax no funds gains tax. Wyomings state-wide sales tax rate is 4 at the time of this articles writing but local taxes bring the effective rate up to 6 depending on the area. Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4.

At 4 the states sales tax is one of the lowest of any state with a sales tax though counties can charge an additional rate of up to 2. Wyoming Department of Revenue Wyoming Internet Filing System WYIFS Governor Mark Gordon. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased.

The state sales tax rate in Wyoming is 4. Contractors must report their use tax on forms.

Wyoming Sales Tax Application Registration

How To Get A Sales Tax Permit In Wyoming International Founders Guide Doola Blog Doola Blog

Wyoming Senate May Approve Internet Sales Tax Wednesday

Wyoming Sales Tax Exemptions Agile Consulting Group

State And Local Sales Tax Rates Sales Taxes Tax Foundation

.png)

How To Get A Sales Tax Permit In Wyoming International Founders Guide Doola Blog Doola Blog

Wyoming Sales Tax Rate Changes April 2018 Avalara

How To Register For A Sales Tax Permit Taxjar

Wyoming Wy State Income Tax Information

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

Taxes In Wyoming Everything You Need To Know About Taxes

How To File And Pay Sales Tax In Wyoming Taxvalet

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

New Wyoming Online Sales Tax Rules

Pay On Line Uinta County Wy Official Website

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Wyoming Internet Sales Tax Bill Sent To Legislature News Wyomingnews Com